വിവരാവകാശനിയമ പ്രകാരം ബോര്ഡിലേക്ക് ഫീസ് അടവാക്കുന്നതിനുള്ള അക്കൗണ്ട് വിവരങ്ങള് ചുവടെ ചേര്ക്കുന്നു.

Thiruvananthapuram Fort Main Branch

Account No. : 103312301011146

IFSC : KSBK0001033

Disclosure under Section 4(1) of the RTI Act, 2005

Kerala Co-Operative Development & Welfare Fund Board

Functions of the board

The major functions are as follows

- To rehabilitate weaker co-operative societies

- To create Risk fund

Co-operative Development and Welfare Fund Scheme

The Kerala Co-operative Development and welfare fund Board is established for implementing Co-operative welfare and Development Scheme as per section 57A of the Kerala Co-operative Societies Act 1969. Kerala Co-operative development and Welfare fund Board is constituted to administer the fund and implement the scheme as per GO (P) No.108/2000/Co-op dated 3-6-2000. The major mission of the board is to rehabilitate the weaker co-operative societies and also to implement development activities for the total upliftment of co-operative societies in the State. To achieve the above motto Kerala Co-operative development and Welfare fund has been established. The fund shall vest in and be administered by the Board.

All Co-operative societies under the control of the Registrar of Co-operative Societies shall become the members of Co-operative welfare and Development scheme. The fund towards the scheme shall consist of initial contribution from the member societies and financial assistance from the Government. The rate of contribution from the member societies are as follows: –

- Initial contribution from the member societies at the rate of Rs.2 per Rs.1000 of the working capital subject to maximum of Rs.2 lakhs in respect of Apex and Central Societies and Rs.1 per Rs1000 of the working capital subject to a maximum of Rs.1 lakh and a minimum of Rs.1000 irrespective of working capital in respect of all other societies at the time of admission. Only half of the above-mentioned rates are applicable to the societies working on net loss as per tentative balance sheet.

- Membership fee to be collected at the time of admission from various categories of societies as follows:

| i) Apex and Central societies | : | Rs.10,000/- |

| (ii) Class I Societies | : | Rs.5000/- |

| (iii) Class II Societies | : | Rs.4000/- |

| (iv) Class III Societies | : | Rs.3000/- |

| (v) Class IV Societies | : | Rs.2000/- |

| (vi) All other societies irrespective of their category and working class | : | Rs.1000/- |

- Annual renewal contribution at the rate of 10% of the initial contribution for apex and central societies and at the rate of 5% of the initial contribution, subject to a minimum of Rs.100 for all other member societies.

- Besides the above, from the year 2019 onwards the Board is charging and annual contribution charges based on the deposits of the societies outstanding at the end of every year.

The whole fund is being used for distributing assistance under the scheme to eligible co-operative societies under the scheme. The Board has sanctioned an amount of Rs.24.87 Crores as loan to the weaker societies under the scheme till 31.03.2024.

Application for assistance under this scheme has to be submitted by the society through the District level Monitoring Committee in the prescribed application form with required details mentioned therein. The application so received will be scrutinize in the Board and if found eligible, will send to the Registrar of Co-operative Societies for opinion. The opinion so received along with the application will then be submitted to the managing committee of the Board for approval. The assistance will be disbursed after obtaining approval from the Board and executing necessary documents by the society.

Risk Fund Scheme (Section57 D of KCS Act, 1969)

The Government has introduced a new scheme “Risk fund Assistance” in the year2008-2009 and entrusted it to the Board. The fund shall consist of 0.70% of loan amount deducted from loanee subject to a maximum of Rs.2,000/- and a minimum of Rs.100/.

As per this scheme, if a loanee of Co-operative society is expired within/after the loan repayment period, principal amount up to 3.00 lakh will be paid by the board to the loan account of the loanee. Also, an assistance of Rs.1,25,000/-(maximum) will be given to the loanees who affect serious deceases after taking loan but within the loan period. (listed diseases- cancer, kidney disease patients undergoing dialysis, heart surgery, paralysis, TB, liver cirrhosis, undergone surgery for liver disease, those who are unable to work and survive due to accidents and diseases, those who have undergone organ transplant surgery, AIDS)

In the cases where the repayment of the loan principal is in arrears for more than 6 months as on the date of death of the borrower during the loan period, or the death occurs after a period of six months of the term of the loan, the applicant will not be eligible to get the assistance. Post-death benefit/medical financing is available only for loans in the name of deceased/terminally ill persons and borrowers who are not more than 70 years of age on the date of death/terminally ill.

In order to get assistance under the scheme, then society has to submit application in the prescribed form along necessary documents to the Head office/ regional office of the Board through the Assistant Registrar/Valuation Officer/Joint Director/Concurrent Auditor. The application thus received will be scrutinized and if found eligible, assistance will be sanctioned. If the application is either defective or ineligible, the matter will be informed to the applicant and the society.

The Board shall consist of the following members

1. Minister for Co-operation (Chairman Ex-officio).

2. President, Kerala State Co-operative Bank.

3. Chairman, State Co- operative Union.

4. President of any two of the District Co-operative Banks to be nominated

by Government.

5. Two representatives of the committee of the Primary Agricultural

Credit Societies to be nominated by Government

6. A representative of the committee of non-agricultural credit societies to

be nominated by Government.

7. Three eminent co-operators to be nominated by Government.

8. A representative of the committee from any other SC/ST Welfare Co-

operatives or Vanitha Welfare co-operatives or any other weaker

section co-operatives under the control of Registrar of Co-operative

Societies.

9. Secretary (Co-operation) to Government of Kerala.

10. Registrar of Co-operative Societies, and

11. Secretary/Treasurer of the Board.

PRESENT BOARD MEMBERS

- V.N. VASAVAN, Minister for Co-operation (Chairman)

- C.K. SASEENDRAN Ex. MLA (Vice Chairman)

- Dr. Veena N Madhavan IAS, Special Secretary to Government

Co-operation Department (Board Member) - Dr. D.Sajith Babu IAS, Co-operative Registrar (Board Member)

- Koliyakode N Krishnan Nair, State Co-operative Union Chairman (Board Member)

- Gopi Kottamurikkal, President Kerala Bank (Board Member)

- Jayakumar K, Joint Registrar/Secretary, Kerala Co-operative Development And Welfare Fund Board (Board Member)

- M. Mohanan, President, Kottayam Service Co-operative Bank, Kottayam, Poyil, Kannur (Board Member)

- J.C. Anil, Director, Thudayannur Service Co-operative Bank, Kollam (Board Member)

- N.K. Valsan, Director, Malanad Labour Contract Co-operative Society, Perambra, Kozhikode (Board Member)

- K.P. Sumathy, President, District Anganavady Workers Helpers Co-operative Society, Malappuram (Board Member)

- Madhu Mullasseri, Director, Thonnakkal Agricultural Co-operative Society, Thiruvananthapuram (Board Member)

The board shall be constituted by the Govt. from time to time and the Minister for Co-operation shall be the chairman and a Vice Chairman shall be nominated by the Government from among the members of the board other than the Chairman. The term of the board shall be for a period of five years.

Offices of the Board

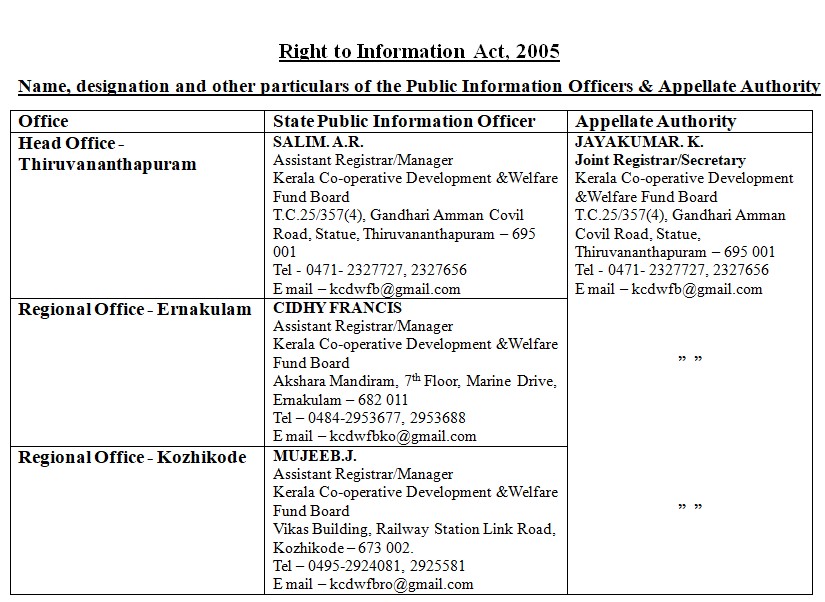

The head office of the Board is located at Thiruvananthapuram and there are two Regional offices at Ernakulam and Kozhikode. A Joint Registrar of the State Co-operative department working under deputation basis under Rule 144 of KSR Part I is the Chief Executive of the Board and three Assistant Registrars from Co-operative department under deputation basis as above, are working in the three offices. Presently, 43 employees are working in the Board.

Risk applications from Kottayam, Idukki, Ernakulam, Thrissur, Palakkad districts are dealt in Ernakulam Regional Office and applications from Malappuram, Kozhikode, Wayanad, Kannur and Kasaragod districts are dealt in Kozhikode Regional office. Risk fund applications from the remaining 4 districts, co-operative development & welfare scheme and all other administrative and financial matters are dealt in the Head Office.

Assistance sanctioned

The Board has sanctioned an amount of Rs.886.96 Crores as risk fund assistance till 25.09.2024. Details are given below.

| YEAR | NO. OF LOANS | AMOUNT |

| 12.8.2009 to 2011 | 1157 | 6.14 Crores |

| 2011-2012 | 1235 | 6.85 Crores |

| 2012-2013 | 3528 | 20.64 Crores |

| 2013-2014 | 3714 | 24.14 Crores |

| 2014-2015 | 6809 | 49.77 Crores |

| 2015-2016 | 9523 | 68.05 Crores |

| 2016-2017 | 7686 | 56.58 Crores |

| 2017-2018 | 9339 | 70.23 Crores |

| 2018-2019 | 10196 | 78.53 Crores |

| 2019-2020 | 10630 | 83.13 Crores |

| 2020-2021 | 9905 | 76.28 Crores |

| 2021 -2022 | 13034 | 99.19 Crores |

| 2022-2023 | 9585 | 86.80 Crores |

| 2023-2024 | 10,609 | 100.19 Crores |

| 2024 – 25.09.2024 | 6680 | 60.44 Crores |

| TOTAL | 113630 | 886.96 Crores |

- Government orders

- Amendments

- Circulars

- Rules of the Welfare Scheme

- Rules of the Risk Fund Scheme

- Application form –Death- Risk Fund Scheme

- Application form –Treatment- Risk Fund Scheme

- Form A Statement

- Challan(RS)

- Application form – Welfare Fund Scheme

- Challan(WS)